Managing debt effectively can be a daunting task, especially for working moms who juggle multiple responsibilities. In this comprehensive guide, we’ll explore various strategies that can help working mothers manage their debt efficiently and regain financial stability.

Understanding Debt and Its Impact

Debt can significantly affect your financial well-being and mental health. It is crucial to understand the different types of debt, such as credit card debt, student loans, and mortgages, to tackle them appropriately.

For working moms, debt can also impact family dynamics and future financial planning. Therefore, it is essential to assess the total debt and its effects on your household’s budget.

Creating a Realistic Budget

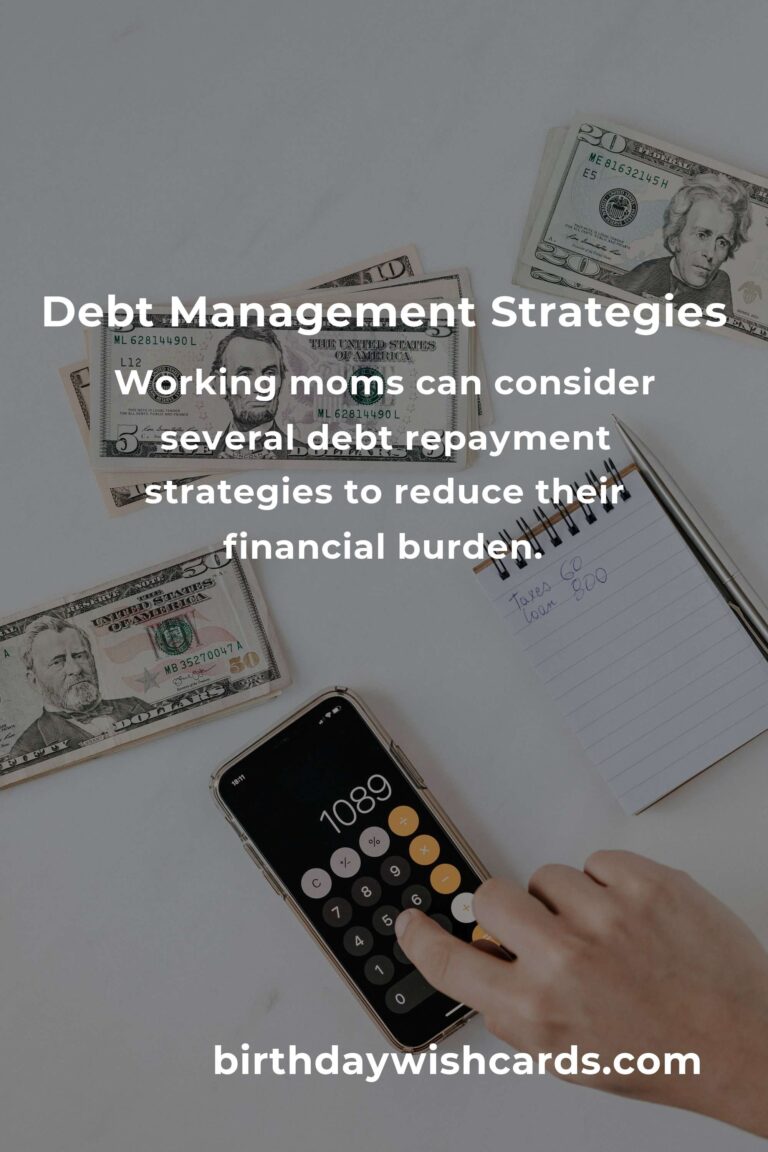

The first step towards effective debt management is setting up a realistic budget. A well-planned budget helps track income and expenses, giving you a clear picture of your financial situation.

Consider using budgeting apps or spreadsheets to monitor your spending habits. Allocate funds for necessary expenses, savings, and debt repayments to ensure a balanced financial plan.

Debt Repayment Strategies

Working moms can consider several debt repayment strategies to reduce their financial burden:

Snowball Method

This method involves paying off the smallest debts first while making minimum payments on larger debts. As each small debt is cleared, the money is redirected to the next smallest debt, creating a snowball effect.

Avalanche Method

In this strategy, focus on paying off high-interest debts first. This approach can save money on interest over time, although it may take longer to see significant progress compared to the snowball method.

Debt Consolidation

Debt consolidation involves combining multiple debts into a single payment, often with a lower interest rate. This method simplifies payments and can lead to lower monthly payments.

Seeking Professional Help

If managing debt becomes overwhelming, working moms can seek professional help from credit counseling services. These organizations provide financial advice, help create budgeting plans, and negotiate with creditors for better repayment terms.

Building an Emergency Fund

An emergency fund acts as a financial cushion during unexpected events such as medical emergencies or job loss. By setting aside a small amount each month, working moms can build a fund that provides peace of mind and prevents further debt accumulation.

Maintaining a Positive Mindset

Debt management can be stressful, but maintaining a positive mindset is crucial. Celebrate small victories and remain focused on long-term financial goals. Involving family members in financial planning can also create a supportive environment.

Conclusion

Debt management is an ongoing process that requires discipline and commitment. By understanding debt, creating a budget, choosing effective repayment strategies, and seeking help when necessary, working moms can take control of their finances and work towards a debt-free future.

Managing debt effectively can be a daunting task, especially for working moms who juggle multiple responsibilities.

Understanding the different types of debt is crucial to tackling them appropriately.

The first step towards effective debt management is setting up a realistic budget.

Working moms can consider several debt repayment strategies to reduce their financial burden.

Debt management is an ongoing process that requires discipline and commitment.

#DebtManagement #WorkingMoms #FinancialStability #Budgeting #DebtRepayment