Paying off student loans can be an overwhelming financial burden for many graduates. The increasing cost of education has led to higher student loan debts, making it essential to find effective strategies to manage and pay off these loans efficiently. In this article, we will explore some practical financial hacks that can help you pay off your student loans faster and ease your financial stress.

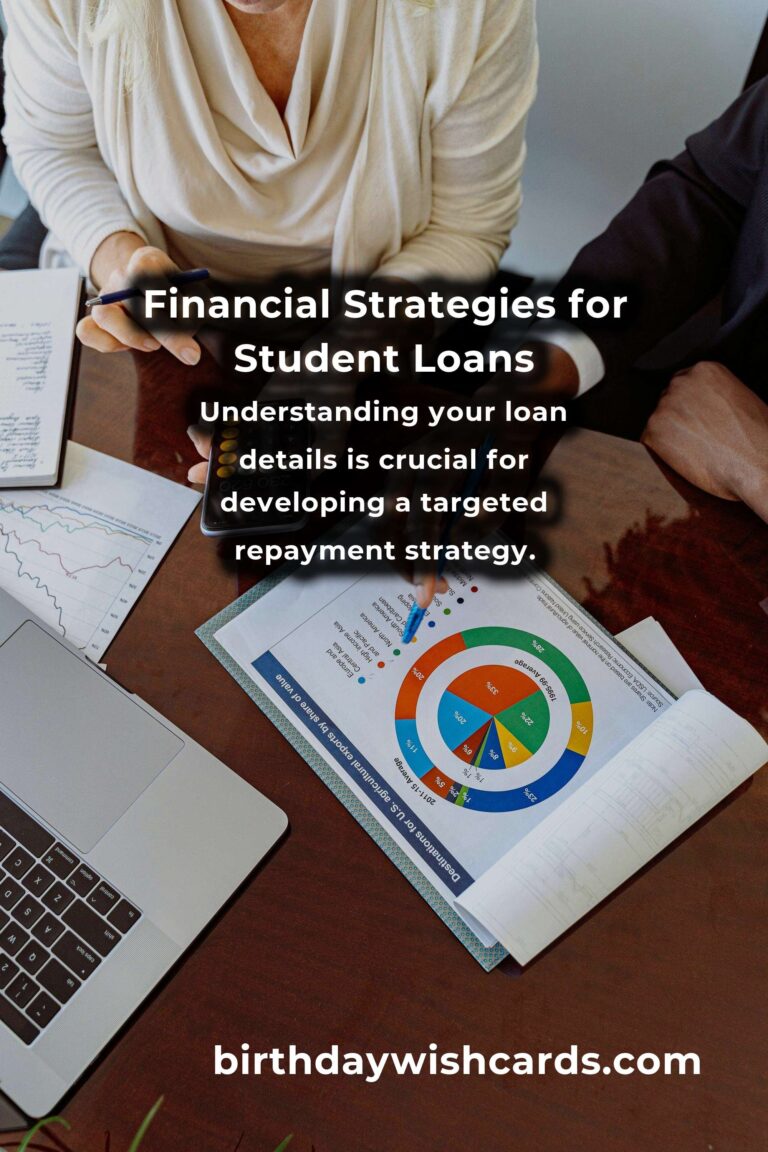

Understand Your Loan Details

Before you can effectively tackle your student loans, it’s crucial to have a clear understanding of your loan details. This includes knowing the total amount owed, interest rates, and repayment terms. By understanding these details, you can develop a more targeted repayment strategy and avoid potential pitfalls such as missing payments or accruing additional interest.

Create a Budget and Stick to It

One of the most effective ways to manage your finances and pay off your student loans is by creating a detailed budget. A budget helps you allocate funds for essential expenses, loan repayments, and savings. By sticking to your budget, you can ensure that you are consistently making your loan payments on time, thereby reducing the overall interest paid and potentially shortening the repayment period.

Make Extra Payments Whenever Possible

Making additional payments on your student loans can significantly reduce the principal amount owed, leading to lower interest costs and a faster repayment timeline. Consider using any extra funds, such as tax refunds, bonuses, or gifts, to make extra payments. Even small additional payments can have a substantial impact over time.

Refinance Your Student Loans

Refinancing your student loans can be a smart financial move, especially if you can secure a lower interest rate. By refinancing, you can reduce your monthly payments and overall interest costs. However, it’s important to carefully consider the terms and conditions of the new loan and ensure that it aligns with your financial goals.

Consider Income-Driven Repayment Plans

If you’re struggling to make your monthly loan payments, consider enrolling in an income-driven repayment plan. These plans adjust your monthly payment based on your income and family size, making it more manageable to pay off your loans. While this may extend the repayment period, it can provide much-needed financial relief in the short term.

Explore Loan Forgiveness Programs

Loan forgiveness programs can be a valuable resource for those working in certain fields or for specific employers. Programs such as Public Service Loan Forgiveness (PSLF) offer loan forgiveness after a certain number of qualifying payments. Research the eligibility requirements and consider if these programs could benefit your financial situation.

Automate Your Payments

Setting up automatic payments can ensure that you never miss a payment, helping you avoid late fees and additional interest charges. Many lenders also offer interest rate discounts for borrowers who enroll in autopay, providing another incentive to automate your payments.

Cut Unnecessary Expenses

Take a close look at your monthly spending and identify areas where you can cut back. By reducing unnecessary expenses, you can free up more money to put towards your student loans. Consider lifestyle changes such as cooking at home instead of dining out, canceling unused subscriptions, or finding cheaper alternatives for entertainment.

Utilize Windfalls Wisely

Whenever you receive unexpected windfalls, such as a work bonus or a tax refund, consider using a portion or all of it to pay down your student loans. These extra payments can help you reduce your debt more quickly and save you money on interest in the long run.

Stay Motivated and Track Your Progress

Paying off student loans is a marathon, not a sprint. It’s important to stay motivated and track your progress over time. Celebrate small milestones and remind yourself of the financial freedom you will achieve once your loans are paid off. Consider using financial apps or spreadsheets to visualize your progress and stay on track.

By implementing these financial hacks, you can take control of your student loan debt and work towards paying it off faster. Remember, the key is to stay disciplined, make informed decisions, and remain focused on your financial goals. With dedication and strategic planning, you can achieve financial freedom and eliminate the burden of student loans.

Paying off student loans can be an overwhelming financial burden for many graduates. Understanding your loan details is crucial for developing a targeted repayment strategy. Creating and sticking to a detailed budget helps manage finances and ensures timely loan payments. Making extra payments can significantly reduce the principal amount owed. Refinancing student loans can reduce monthly payments and overall interest costs. Income-driven repayment plans adjust monthly payments based on income and family size. Loan forgiveness programs offer relief for those working in certain fields. Automating payments helps avoid late fees and additional interest charges. Cutting unnecessary expenses can free up more money for student loans. Utilizing windfalls wisely can help reduce student debt more quickly. Staying motivated and tracking progress is important in paying off student loans.

#StudentLoans #FinancialHacks #DebtFreeJourney